Just like the ‘old days’ pre-Covid, leadership books by well-known business and sporting personalities are being rushed out before Christmas. Among these lazy stocking fillers, for the spouse who has everything, is a relatively instructive tome by England rugby coach Eddie Jones.

No stranger to these pages, as we regularly look to the world of sport for inspiration when facing business challenges, the Tasmania born, part Japanese-American Jones possibly overestimates his grasp of ‘the English (read British) condition’, which he readily applies to the workings of the media and the corporate world, as well as to rugby. Nonetheless, he is a realist who knows the value of shaking things up at the right time and the dangers of blindly doing the same thing while expecting a different outcome. Speaking of his team’s struggle in the 2021 Six Nations tournament, Jones writes:

“England lost their way partly because of a creeping sense of entitlement which ate away at the core values and principles we had established. Complacency corrupts the soul of the team. When that happens, the core of the team cracks open and you have to start again.”

The next quarter will see the second anniversary of lockdown and the (now ended) schemes for furlough and government assistance for businesses. Prices are rising, the prospect of higher interest rates is very real and taxes will be higher to pay for the support of the last two years. This is no time for businesses, large or small, to be complacent. As a second difficult year ends, directors and managers must plan, reshape, revise, reorganise and face their challenges head-on. It may be a cheesy old adage, but it’s never been truer: fail to prepare and prepare to fail.

As ever, the Buchler Phillips approach to business challenges is ‘workout, not bail out’. Don’t hesitate to get in touch for an exploratory chat if your business needs help. Addressing the cracks now will, in many cases, avoid the need to start again.

Our helplines below are open for free initial consultations:

Larry Jobsz 07770 350713

Paul Davis 07976 328991

Jo Milner 07990 816904

Barry Lewis 07831 529831

David Buchler 07836 777748

Let’s get to work!

Mergers and Acquisitions remain strong

Exploring the sale of a company, merging with a complementary business or taking the opportunity to acquire another operator in your sector are all important options to consider when reviewing strategy or even a broad restructuring. Asset prices, including company valuations, were understandably under pressure in 2020 and 2021, allowing those with financial firepower to take advantage of potential bolt-on purchases, defensive acquisitions and more. The breadth of financing available, at a relatively low cost until now, has also helped: family offices, Ultra High Net Worth Individuals and well-funded private businesses have been active on the M&A scene, picking up some of the slack left by public companies less able to pay for deals with undervalued paper. Private equity firms, less constrained by markets, have been particularly active in accelerating buy-and-build strategies for their portfolio companies.

The Office for National Statistics (ONS) recorded £46.5 billion worth of deals transacted in Q3 2021. Specific reasons cited have been a drive for generating new value and delivering new efficiencies. The recent COP26 climate summit is thought to have focused many businesses on sustainability and ESG issues, some of which have been solved in part by buying other enterprises with better developed strategies in those areas. The UK is expected to remain attractive for inbound M&A, especially in its notable sectors of financial services, fintech and premium consumer goods. Looking outward, domestic consolidation and outbound M&A continue as UK businesses seek to raise their profile overseas. Q4 2021 is believed to have been similarly buoyant and the same wide range of transactions, from distressed sales to large growth opportunities look set to continue into Q1 2022.

We are very interested to hear from business owners, directors and investors wishing to conduct expert due diligence, prepare for capital raising or explore strategic options for non-core operations.

Covid help and Brexit: two important changes from 1 January 2022

Many businesses will see government support in the form of loans and grants all but dry up from the beginning of next year. Others trading outside the UK will start to operate within a more rigid post-Brexit framework.

Recovery Loan Scheme

Originally due to end on 31 December 2021, the RLS was extended in the autumn Budget for a further six months until 30 June 2022. However, from 1 January 2022, the following new conditions will come into force:

- The RLS will be open only to small and medium sized enterprises (SMEs) – there were no previous restrictions on business size

- The maximum amount of finance available will be £2 million per business

- The Government-backed guarantee to lenders will be reduced to 70 per cent

Further details can be found on the Government’s website here.

RLS funds are available for any legitimate business purpose – it has been aimed at businesses that cannot afford to take out additional loans. To qualify under existing terms of the RLS, businesses must apply and receive a formal signed loan offer by an accredited lender by 31 December 2021. This has not to date been a quick process, so businesses should act quickly if they wish to access funding from the RLS on its existing terms.

Full Customs Controls

HMRC is reminding businesses to prepare for customs changes that come into effect on 1 January 2022.

There will be important new rules on:

- Customs declarations

- Border controls

- Rules of origin – for imports and exports

- Postponed VAT Accounting

- Commodity codes

More details can be found on the Government’s website here.

Further changes will come into force on 1 July 2022, but many trade bodies are warning of businesses’ lack of readiness for the new year. The Federation of Small Businesses says only a quarter of small British importers are ready for new border controls on imports from the EU. A lack of capacity among small companies to handle the new paperwork could further disrupt stricken supply chains immediately after the demanding Christmas period. From January 1, companies will no longer be able to delay making import customs declarations for EU goods; instead they will have to make declarations and pay relevant tariffs at the point of import. Notice of imports of food, drink and products of animal origin will also be needed to be given in advance. The FSB says one in eight importers said they were unable to prepare for the introduction of checks.

Goods must be accompanied by a valid declaration and have received customs clearance, without which they will not be released into circulation and in most cases will not be able to leave the port. Goods may be directed to an inland border facility for documentary or physical checks if these checks cannot be done at the border. In addition, supplier declarations will be needed for the first time to export goods to the EU using tariff preferences, a reduced rate of customs duty granted as long as there is proof of origin. Commodity codes used worldwide to classify goods that are imported and exported will also change on January 1.

Zombie Apocalypse

There is little doubt than many companies have been artificially propped up by Covid loans over the last 20 months. However, with assistance and forbearance ending, the future of these businesses is not as simple as thrive or go bust. A large number will be left in a ‘zombie’ state: only just able to cover their debts and unable to invest in growth. It may be an unforeseen consequence of state-backed, but ultimately commercial borrowing during the first phase of the pandemic. There is no prospect of converting any of this debt into equity, and companies that may have been trading at modest profitability pre-Covid are now, after an extended period of depressed trading, faced with treading water at best, solely to service borrowing.

Owners and managers of such businesses must waste no time in seeking advice about restructuring or dealing with other creditors, including HMRC. Time to Pay and Creditors Voluntary Agreements are a small part of the insolvency toolkit that contains many routes to preserving inherent value in business while addressing seemingly insurmountable problems.

About Buchler Phillips

Buchler Phillips is the UK’s oldest independent corporate recovery and restructuring firm, with a professional heritage dating back to the 1930s.

Led by David Buchler, former Europe and Africa chairman of global consultancy Kroll Inc, our senior team is equally comfortable advising large corporations, Small & Medium Enterprises (SMEs) or individuals. In addition to decades of experience, each of our Partners brings to any given assignment unique independent insight, free from conflicts of interest, that is often sought but rarely found by clients or co-advisors.

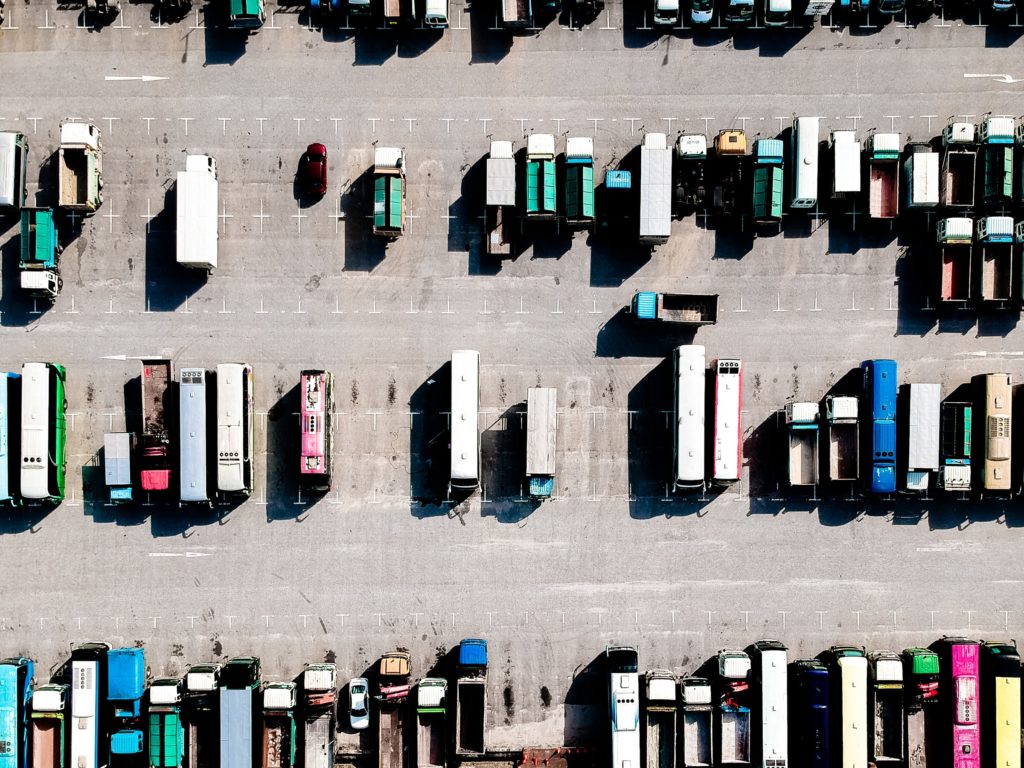

The firm is sector-agnostic, but has particularly strong credentials in property; financial services; professional services; leisure and hospitality; retail and consumer; UK sports; media and entertainment; transport and logistics; manufacturing and engineering; technology and telecoms

Our activities fall broadly, though by no means exclusively, into financial restructuring, including fraud and forensic investigations; operational restructuring and turnaround; expert witness services and recovery solutions for corporates and individuals.

This bulletin is published for the purposes of general information only and does not constitute advice. Any action taken by readers upon the information above is entirely at their own risk.